Disney, Ford, Microsoft and the age of the quasi-merger

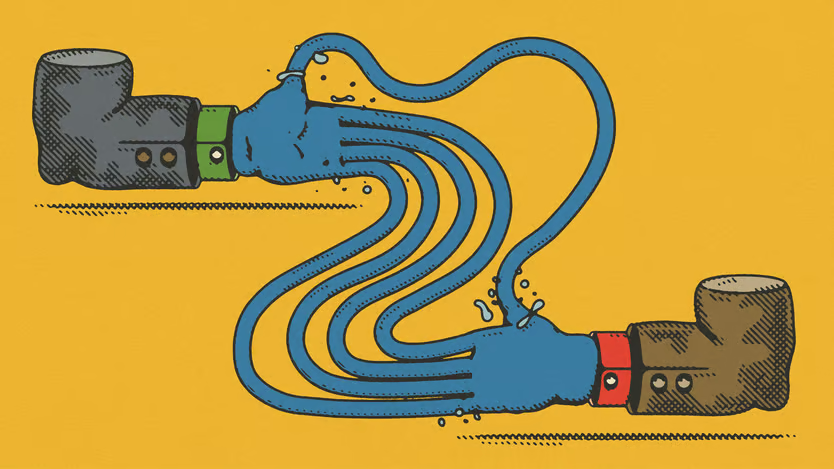

No firm is an island. All strike contracts and compete with others. Conversely, when bosses decide a relationship would be better governed by fiat, one firm may acquire another—as bhp, a $150bn mining giant, proposed to do with a $35bn rival, Anglo American, on April 24th. Yet between the poles of contract and total commitment are plenty of ways for firms to combine capital, knowledge or other resources, without fully tying the knot.

Such in-between arrangements are winning favour across the economy, from tech and artificial intelligence (ai) to carmaking and energy. While corporate takeovers stalled in 2023, a few mega-mergers notwithstanding, the number of joint ventures (jvs) and partnerships jumped by 40%, according to Ankura, a consultancy. They are especially popular in areas of rapid technological change and in places given to protectionism, which these days afflicts rich and poor countries alike. With barriers to commerce rising, high interest rates contining to bite and regulators bridling at takeovers, such liaisons are becoming the go-to way to enlarge a business empire, as the recent actions of companies including Disney, Ford and Microsoft illustrate. Call it the age of the quasi-merger.