Business

Disney saw off an epic proxy challenge from Nelson Peltz at its annual general meeting. Through Trian, his hedge fund, Mr Peltz was seeking two seats on the company’s board to “restore the magic”, claiming that poor management and box-office failures have contributed to the underperformance of Disney’s share price. But Bob Iger, the chief executive, fought an extensive campaign defending his turnaround strategy, which won the support of BlackRock, the Disney family and George Lucas, a film producer. Mr Peltz reportedly received just 31% of the vote for his claim to a seat.

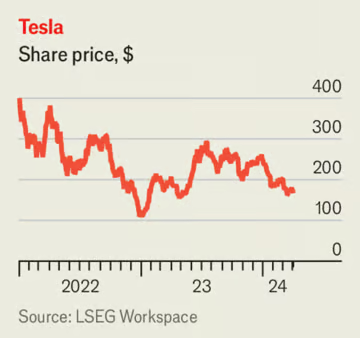

Tesla delivered 386,810 vehicles worldwide in the first quarter of 2024, a decrease of 8.5% year on year and its first quarterly decline on that basis since 2020. Investors, already rattled by slowing growth in the electric-vehicle industry, punished Tesla’s stock. Figures from other carmakers were mixed. Ford and Hyundai reported a big rise in ev sales in America, and General Motors announced a sharp decline.

Despite the fall in deliveries, Tesla reclaimed its crown as the world’s biggest seller of evs, after BYD sold just 300,000 pure-electric vehicles in the first quarter. That is far below the more than 526,000 that byd shifted in the last three months of 2023, when it overtook Tesla in sales.

Xiaomi entered China’s fiercely competitive ev market when it started selling its new su7 four-door sedan, which has a lower-than-expected starting price of $30,000. The Chinese tech company is better known for its smartphones. It took nearly 90,000 orders for the car over 24 hours, though customers may have to wait up to seven months for a delivery.

A meeting of minds

America and Britain signed an accord to “build a common approach” on ensuring the safety of artificial intelligence, the first agreement of its kind in the world. Although America has far more ai startups, Britain is home to DeepMind, a developer of neural networks that is owned by Google. Britain opened its ai Safety Institute last November. America’s parallel institute is still being organised.

Microsoft decided to sell its Teams chat application separately from its Office 365 suites around the world. It unbundled the products in Europe last year to avert an antitrust fine from the European Commission.

Sam Bankman-Fried insisted that “I never thought that what I was doing was illegal,” after he was sentenced to 25 years in prison for fraud at ftx, a cryptocurrency exchange he founded that collapsed in 2022. The sentencing judge said that Mr Bankman-Fried had committed perjury during his testimony to the court, and shown no remorse for his actions.

SLB, the world’s biggest provider of oilfield services, agreed to buy Champion X, which specialises in production chemicals and artificial lift solutions, such as jet pumps. It is the biggest acquisition by slb, formerly known as Schlumberger, since 2016.

The price of natural gas in Europe fell, after it was reported that gas-storage in the eu was around 60% full, a record high for this time of year. That will rise in the coming warmer months as gas supplies are replenished. Two years ago Europe faced soaring gas prices amid Russia’s invasion of Ukraine and low storage levels. The price of tff, Europe’s benchmark gas contract, now trades around €25 ($27) per megawatt hour compared with €56 a year ago.

Oil prices reached five-month highs, amid concerns about conflict in the Middle East and attacks on Russian refineries. Brent crude traded close to $90 a barrel.

The euro zone’s annual inflation rate fell to 2.4% in March, closer to the European Central Bank’s target of 2%.

“Today we begin again,” said General Electric, as it completed its transition to three stand-alone companies, each listed separately on the stockmarket. ge Aerospace houses jet engines and aviation services, ge Vernova is the energy business, focusing on wind and gas turbines, and ge HealthCare supplies imaging, ultrasound and it systems to hospitals. Founded in 1892, ge no longer exists as a conglomerate. Larry Culp, ge’s boss, is now ceo of ge Aerospace.

Mr Trump’s business model

The share price of Trump Media, Donald Trump’s social-media platform, slumped after it revealed a huge drop in quarterly revenue and a yearly net loss. Trump Media only recently went public on the stockmarket. In a regulatory filing the company’s auditors noted that there is “substantial doubt about its ability to continue as a going concern”. Meanwhile Mr Trump is embroiled in a legal fight with two founders of the business, claiming they shouldn’t receive shares in it.